Our context

The human condition and the health of our planet are inextricably linked. Our collective resilience, well-being, and ability to navigate crises are fully connected to the food we eat, the water we drink, the air we breathe and, crucially, our relationship with the earth. Human activity has impacted every part of our planet, with less than 25% of land unaffected, and is projected to drop below 10% by 2050 without significant action. Up to 75% of freshwater and more than 50% of marine areas are used for food production. Wild mammal biomass has decreased by 82% since the stone age, with an estimated 38%–46% biodiversity loss by 2050. A million species face extinction without urgent action, and climate change is accelerating with record-breaking events increasing in frequency and severity, the 1.5-degree temperature limit having been breached in 2024 and devastating fires and floods seen across the globe. United Nations Environment Programme (2024).

Territorial conflicts, migration, and resource pressures frequently result in significant spillover effects. This phenomenon is notably observed in the triple planetary crisis involving pollution, biodiversity loss, and climate change.

The 2025 WEF Global Risk Report underscores the urgent need for comprehensive collaborative action to minimise and mitigate the negative impacts of environmental risks. It recommends accelerating efforts to mitigate climate change by reducing greenhouse gas emissions and investing in renewable energy. It also highlights the importance of enhancing biodiversity conservation through robust strategies to protect and restore ecosystems. Promoting sustainable practices across industries and communities is essential for long-term environmental health, and building resilience in communities and ecosystems is crucial for withstanding environmental shocks and stresses.

Delivering on this starts with actively managing these emerging business risks in a manner that considers the Just Transition as well as future generations in decision-making. All stakeholders can make strategic interventions to protect the environment and societal well-being and therefore our focus on environmental limits as a material matter.

WEF top 10 risks for the next 10 years

1 Extreme weather events

2 Biodiversity loss and ecosystem collapse

3 Critical changes to earth systems

4 Natural resource shortages

5 Misinformation and disinformation

6 Adverse outcomes of AI technologies

7 Inequality

8 Societal polarisations

9 Cyber-espionage and warfare

Role for the financial sector

Despite headwinds such as political shifts in some regions that have encouraged scepticism towards sustainability and ESG, the financial risks and opportunities from addressing climate change and nature are substantial and growing. The financial sector needs to continually assess their climate and nature strategies, ensuring that they are able to meet evolving client needs. This involves updating commitments and targets based on the latest science, examining the pace of progress, and ensuring operating models and supporting policies are fit for purpose.

Banks have massive opportunities in supporting sustainable development. These include support for mature technologies with economic advantages and helping hard-to-abate sectors transition. Banks should establish relationships with emerging champions in mature sectors while supporting early-stage technologies in hard-to-abate sectors through equity, risk sharing, and corporate-level financing. Enhanced approaches to managing physical risk, adaptation finance, and transition risk are also required. This includes addressing risks in supply chains, supporting material adaptation, and incorporating greater disruption and volatility within transition analyses.

By embracing innovative financing models, expanding strategic partnerships, and committing to science-aligned targets, Africa can close its finance gap and achieve resilient, inclusive, and sustainable growth. However, decisive, collaborative action is urgently needed. By focusing on these areas, we can deliver enhanced returns to shareholders and play a vital role in accelerating the shift to a lowercarbon and more just and resilient economy. As part of our commitment to the climate and nature agenda, we are dedicated to enhancing access to adaptation and green finance, managing climate and nature-related financial and reputational risks, and monitoring the climate impacts of our lending portfolio. Additionally, we have started the process to understand our impact and dependencies on nature.

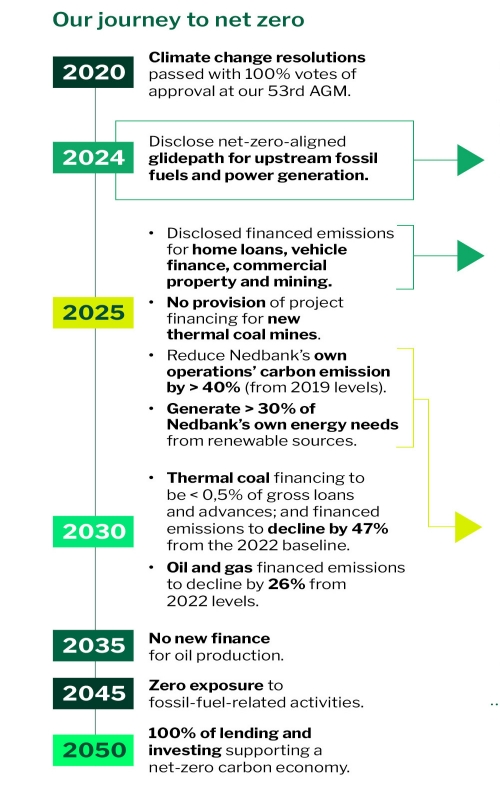

Nedbank targets and commitments

As of 31 December 2024, we had R183bn of exposures that support SDF, representing 19% of our gross loans and advances (2023: R145bn, 16%). Our ambition, set in 2022, was to increase this to 20% by the end of 2025, after which we will be looking to set a new target to 2030, as we expect these exposures to grow at least 1,5 times faster than traditional loans. Growth is likely to be driven by SDG 7 (renewable energy), SDG 12 (agriculture), SDG 8 (SMME lending) and SDG 6 (water).