Share price

Nedbank Group is listed on the JSE Limited stock exchange under the JSE share code NED, with the secondary listings on the Namibian Stock Exchange and A2X.

The Nedbank Group has many characteristics that differentiate us from our universal banking and financial services peers in SA as we focus on sustainable value creation for our shareholders and all other stakeholders. These include the benefits of having a diverse and experienced board and leadership team, financial targets and strategy that supports value creation as we progress towards a 17% return on equity (ROE) in the medium term and more than 18% in long-term, executed through strong and differentiated franchises, and enabled by a world-class modern technology platform, leadership in client satisfaction metrics and a unique corporate culture.

Good governance and oversight are underpinned by a diverse, independent and experienced board, while the Group Exco has more than 200 years of combined experience and is highly regarded by the investment community.

At Nedbank we have a proud track record of doing business in a manner that contributes positively to society and the environment, supported by good governance and ESG leadership.

The group set’s itself ambitious stretch targets that, when achieved, creates shareholder value. The targets are underpinned by a clear strategy that focused on growth, productivity and sound risk and capital management.

Our frontline clusters comprise Corporate and Investment Banking (CIB), Business and Commercial Banking (BCB), Personal and Private Banking (PPB) and Nedbank Africa Regions (NAR). Our frontline clusters position us well to compete, lead and grow into the future.

The group’s balance sheet is very strong. CET1 and tier 1 capital ratios, as well as liquidity ratios are well above board-approved target ranges and SARB minimum requirements. This positions the group well to capitalise on growth opportunities, complementary bolt-on M&A (should it arise), pay dividends at top-end of our payout ratio, subject to board approval and flexibility in capital management should share buyback opportunities present themselves.

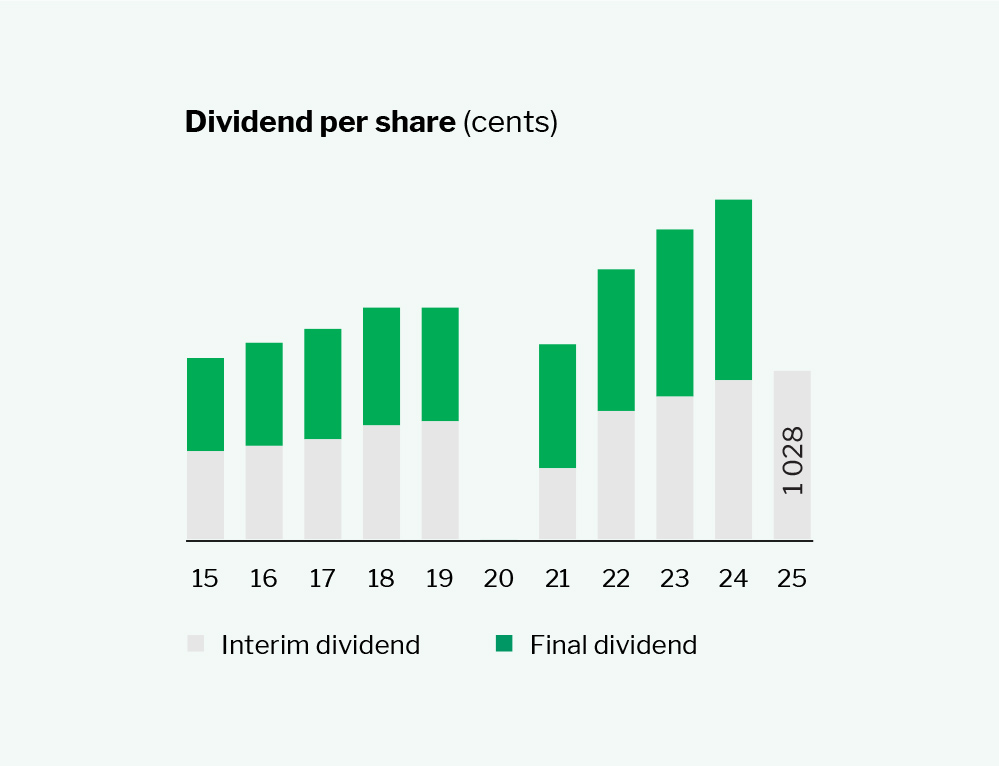

In addition to solid earnings growth and an increasing ROE trajectory, ordinary dividends have recently been declared at a 57% payout ratio. The group’s dividend policy is for the board to declare dividends within its board-approved dividend cover range of 1,75 to 2,25 times, subject to the company meeting the solvency and liquidity requirements.

Improving the group’s return on equity (ROE) towards our medium and long-term targets will be value creating, supporting a higher price to book ratio. To achieve our ROE targets, we need to:

deliver strong net interest income (NII) growth, underpinned by market share gains across key retail credit and deposits categories, while participating in the large infrastructure opportunities in SA,

improve our credit loss ratio (CLR) towards the mid-point of the group’s through the cycle range of 60 bps to 100 bps,

deliver strong non-interest revenue (NIR), underpinned by ongoing main-banked client gains and cross-sell, leveraging our balance sheet for growth and unlocking a large insurance growth opportunity,

manage expenses growth for positive jaws (revenue growth greater than expense growth), and

unlock capital optimisation opportunities when they present themselves.

Nedbank Group is listed on the JSE Limited stock exchange under the JSE share code NED, with the secondary listings on the Namibian Stock Exchange and A2X.

The Nedbank ordinary shares trade on the following exchanges:

JSE Limited share code: NED

Namibia Stock Exchange (NSX) share code: NBK

A2X share code: NED

Company registration number: 1966/010630/06

ISIN: ZAE000004875

JSE alpha code: NEDI

The following tool provides information on the Nedbank closing share price and the volume of shares traded over time:

Our authorised and issued share capital and major ordinary shareholders.

|

|

|

|

|---|---|---|

Number of shares |

||

600 000 000 |

||

486 918 386 |

||

477 272 628 |

||

Number of shares |

Shareholding % |

|

71 545 098 |

14,7 |

|

44 721 821 |

9,2 |

|

22 615 260 |

4,6 |

|

19 626 113 |

4,0 |

|

19 041 667 |

3,9 |

|

17 246 922 |

3,5 |

|

15 976 023 |

3,3 |

|

15 486 086 |

3,2 |

|

14 571 230 |

3,0 |

|

8 383 012 |

1,7 |

|

Number of shares |

Shareholding (%) |

|

77 837 617 |

16,0 |

|

31 893 060 |

6,6 |

|

Number of shares |

Shareholding (%) |

|

293 958 283 |

60,4 |

|

11 130 178 |

2,3 |

|

91 760 812 |

18,9 |

|

34 380 255 |

7,1 |

|

23 550 016 |

4,8 |

|

16 583 207 |

3,4 |

at 30 June 2025

Index-classified shareholding: 30,7%

Foreign shareholding: 37,3%

Nedbank Group generally pay dividends to its ordinary shareholders twice a year following the announcement of the company's full-year and half-year results.

The group’s dividend policy is for the board to declare dividends within its board-approved dividend cover range of 1,75 to 2,25 times, subject to the company meeting the solvency and liquidity requirements in terms of the SA Companies Act, 71 of 2008.

Period

6 months ended

30 June 2025 (interim)

Last day to trade

2 September 2025

Payment date

8 September 2025

Amount per share

1 028 cents

*Capitalisation award with cash dividend election

The Nedbank share is covered by a wide range of sell-side analysts.

Broker |

Analyst |

|

|---|---|---|

Ilan Stermer |

||

Adrienne Damant |

||

Harry Botha |

||

Simon Nellis |

||

Henry Hall |

||

Ross Krige |

||

Baron Nkomo |

||

James Starke |

||

Charles Russell |

||

Stephan Potgieter |

The following dividend and earnings consensus forecasts for Nedbank are extracted from Iress Market Ratings based on the sell-side analysts covering the Nedbank share.

Financial year end |

Diluted headline earnings per share |

Dividend per share |

Return on equity |

|---|---|---|---|

(cents) |

(cents) |

(%) |

|

3 538 |

2 075 |

15.8 |

|

3 605 |

2 119 |

14.9 |

|

3 810 |

2 229 |

15.0 |

|

4 196 |

2 460 |

15.4 |

Last update: 24 November 2025

Source: IRESS

The Nedbank Group shares are available as American Depositary Receipts (ADRs). The Bank of New York Mellon is our depositary and maintains our ADR holder register.

An ADR is a negotiable US certificate representing ownership of shares in a non-US corporation. ADRs are quoted and traded in US dollars in the US securities market. Also, the dividends are paid to investor in US dollars. ADRs were specifically designed to facilitate the purchase, holding and sale of non-US securities by US investor, and to provide a corporate finance vehicle for non-US companies.

Information and resources related to the Nedbank Group’s warrant and exchange traded note programme, and structured products.