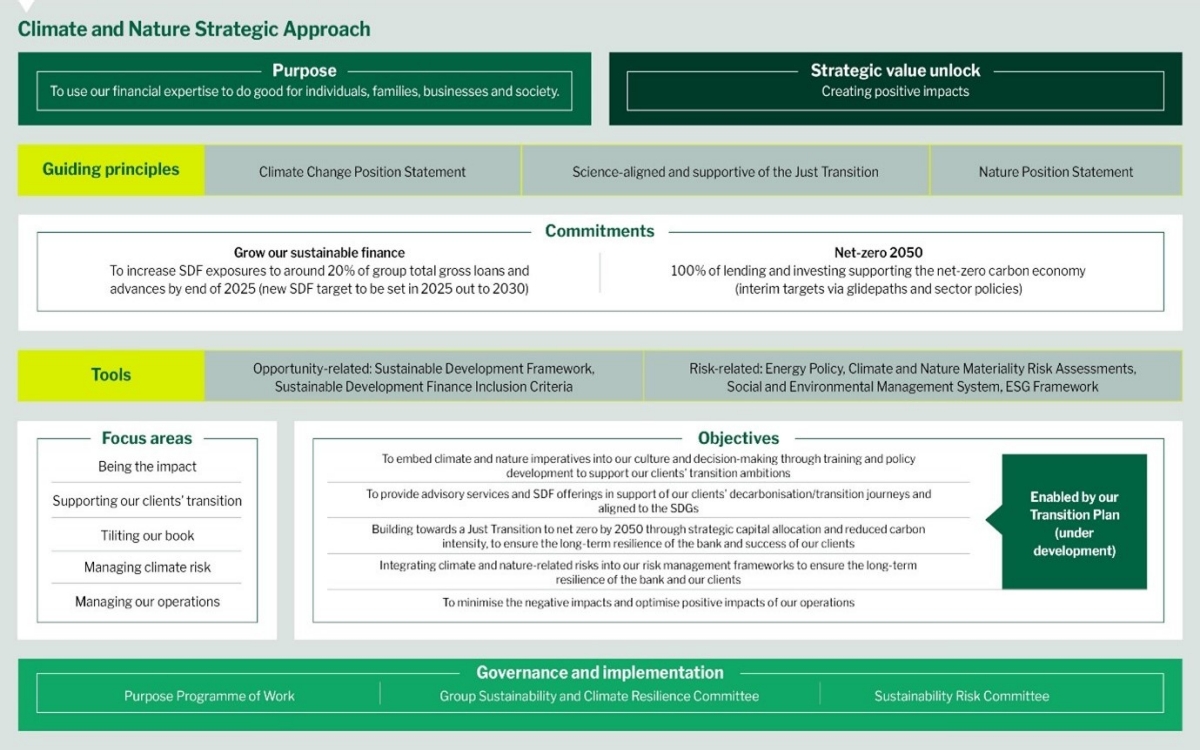

Climate and nature approach

Nedbank's strategic approach to climate and nature Sustainable growth is vital for the economy, and by incorporating the emerging business risks (and opportunities) of climate and nature into our strategic plans we aim to encourage growth that yields positive environmental and social outcomes.

We are integrating social and environmental sustainability into core operations as part of our overarching group business strategy through the strategic unlock of ‘creating positive impacts,’ recognising the critical interdependence between climate and nature and societal inclusion and well-being.

Our approach in this regard is guided by our Climate Change and Nature Position Statements that are both aligned to the required science and support the realisation of a Just Transition. Our commitment is to achieve net zero emissions by 2050, demonstrating our dedication to mitigating climate change and aligning with global efforts to limit temperature rise. Additionally, we are committed to significantly growing our sustainable development finance, funding initiatives that promote renewable energy, energy efficiency, and other environmentally beneficial projects. This dual commitment underscores our leadership in fostering a sustainable future and supporting the transition to a low-carbon economy.

We use tools such as our Sustainable Development Framework and Energy Policy to meet our commitments to sustainable development finance and support the transition to a net-zero economy, respectively. We recognise the concept of double materiality, acknowledging both the impact the bank has on the environment and society through its operations and provision of finance and investment, and the risks that climate change poses to the organisation. Our focus areas – being the impact, supporting our clients' transition, tilting our portfolio towards sustainable assets, managing climate risk, and managing our own operations shape our approach and determine the work undertaken while ensuring that we consciously manage our impacts and aim for positive outcomes for the environment and society.

Responsible capital allocation is fundamental, and we are increasingly directing resources towards initiatives that align with our climate and nature commitments, recognising the powerful impact of capital in driving positive change. As such we are innovating to create financial solutions that accelerate the transition to support our clients in reducing their environmental impact and increasing their economic resilience. Ongoing engagement with clients and other stakeholders to evolve our strategy is crucial to ensure that we support the required Just Transition at the pace required by science.

Our climate and nature strategy

Our slimate and nature stategy is formed by our Climate Change Position and Nature Position Statements and guided by our group strategy, Sustainable Development Framework, commitments to sustainable development finance, related policies, such as our Enegy Policy and our climate focus areas.

As part of our purpose-led business journey, we take a proactive stance in addressing climate change, considering the local socioeconomic context and climate vulnerability. Our commitment extends to continuously enhancing our reporting by embedding financial climate-related risks and opportunities into our business activities.

Recognising that climate change poses a significant threat to society, Nedbank is committed to achieving the goals of the Paris Agreement. Our aim is to contribute to keeping global warming well below 2°C and to pursue efforts to limit the temperature increase to 1,5°C above pre-industrial levels by 2050. We acknowledge that all stakeholders must play their part in this critical endeavour. At Nedbank, we see money differently. Our values, vision, and purpose drive our climate journey, which aims to make a positive impact on the world.

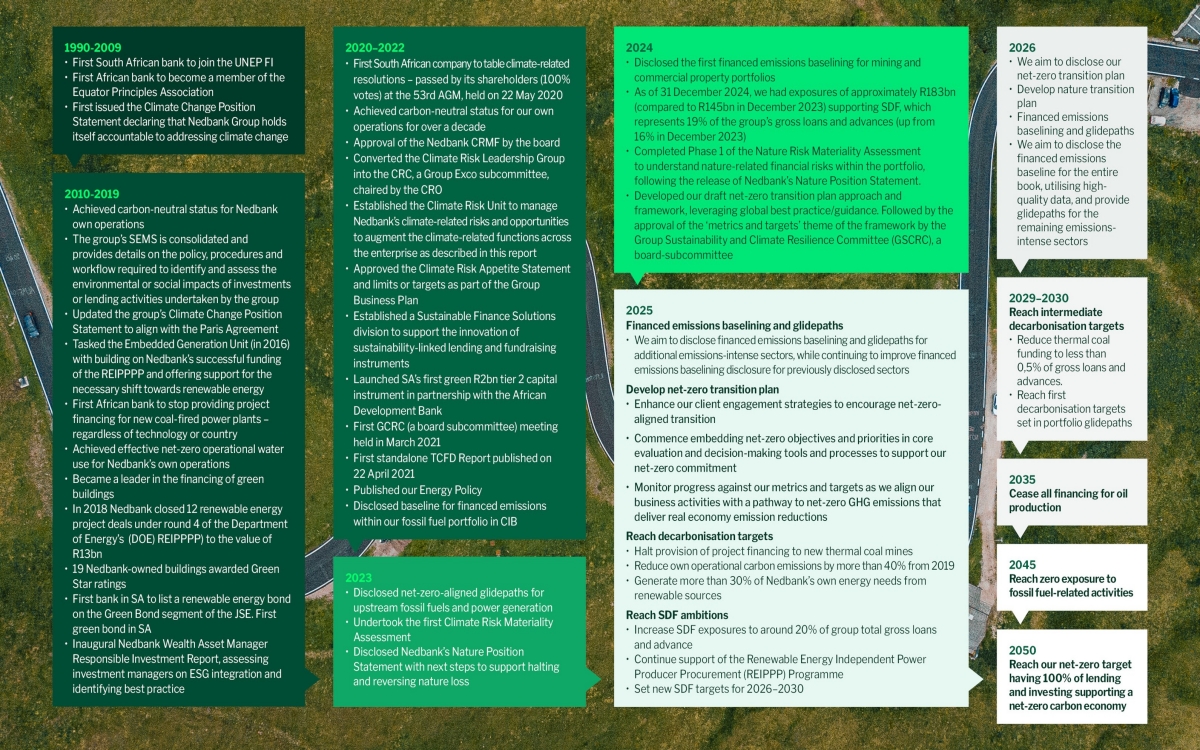

Towards 2050 - Nedbank Group climate journey

As part of our purpose-led business journey, we take a proactive stance in addressing climate change, considering the local socioeconomic context and climate vulnerability. Our commitment extends to continuously enhancing our reporting by embedding financial climate-related risks and opportunities into our business activities.

Recognising that climate change poses a significant threat to society,Nedbank is committed to achieving the goals of the Paris Agreement. Our aim is to contribute to keeping global warming well below 2°C and to pursue efforts to limit the temperature increase to l,5°Cabove pre-industrial levels by 2050. We acknowledge that all stakeholders must play their part in this critical endeavour.

At Nedbank, we see money differently. Our values, vision, and purpose drive our climate journey, which aims to make a positive impact on the world.

Our climate journey for our lending activities, investment practices and own operations is provided below.